Five Best Practices For PE Firms Conducting Expert Research

Private equity firms run on research.

Many use research services providers to connect them to knowledgeable experts who can shed light on the industries, companies, and trends they need to understand. Why? By working with these providers, analysts are able to present their deal teams with deeper insights, faster. But to be effective, PE analysts must make the most of these interviews with experts.

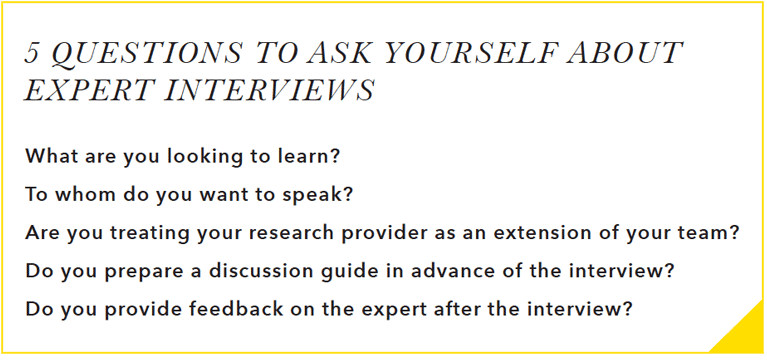

Do you apply these five best practices to your expert research? (The bonus: some of these tips can be used for other types of research you arrange on your own.)

1. Let your provider know as much as you can about what you’re looking to learn.

Are you looking to get smart quickly or taking a deep dive?

What industry or business line are you trying to learn more about?

What specific questions do you seek to answer?

What are your internal deadlines?

This information is used to identify, screen, and often custom recruit experts before they are presented to you. The more you can share, the more satisfied you’re likely to be with the suggested roster of experts.

2. Describe the kind of people to whom you want to speak.

What’s your angle?

Once you’ve clearly described your objectives, the project manager will often have a good idea of who to tap. But remember, you know your project better than they do. Spending a couple of minutes outlining the ideal expert profile—role, title, functional responsibility, and/or specialty—goes a long way. Specify if you are interested in speaking with former employees at a particular company, employees of its competitors, or its customers. Or perhaps you’re looking for the perspective of suppliers, professional consultants, distributors, or regulatory experts. Clear direction will get you closer to the results you desire.

3. Prepare for the interview.

Now that the ideal expert is vetted and ready to speak to you, the next hurdle is the interview. Here’s a quick refresher on best practices for expert interview preparation:

Prior to the call, outline your discussion points. Consider sharing them with the expert in advance so they have time to prepare thoughtful answers.

To maximize your learning during the interview, ask open-ended questions to encourage discussion and dialogue.

Avoid using industry lingo, which can cause confusion. Think about the disconnect that can occur when a financial analyst speaks with a physician and each party uses its own industry jargon. (Your conversation might make a good SNL skit, but it’s not a good model for effective research.) Communicate using plain language, and encourage your expert to do the same.

Close the loop at the end of the interview. Review your objectives and outline before ending the call to be sure you’ve learned everything you need to know.

4. Treat your provider as an extension of your deal team.

As your research evolves in real time, try to keep your provider in the loop. For example, let them know if you’ve had such a great call with one expert that you don’t need to speak to any others, or if you’re heading out to a conference and prefer to be contacted via text.

Every time you communicate, you help your provider work faster and smarter, which benefits you.

5. Provide feedback.

What worked well? What didn’t? Which experts hit the mark, and are you likely to use those experts again? At Guidepoint, we appreciate the positive notes we receive about a job well done or the performance of a particular employee, but we actually learn more from constructive criticism, as it helps us serve you better.